Information models, XSD and encoding

XSD for the VAT return

Change log

| Date | What changed? |

|---|---|

| 2021.06.21 | Updated code list mvaSpesifikasjon, correcting "tap på krav" to "tapPåKrav" |

| 2021.08.31 | Updated with description of the fields in the VAT return submission |

| 2021.09.13 | New table describing the usage of SAF-T codes |

| 2021.09.21 | Information model for VAT return updated. SAF-T codes not to be reported (0,7, 20,21 and 22) are removed. |

| 2021.10.12 | Updated code list merknadTilsvarendeMvaKode, including removal of duplicates |

| 2021.10.15 | Updated code lists |

| 2021.10.21 | Updated description of period and taxation period with information about SkattleggingsperiodeUke and SkattleggingsperiodeHalvmåndelig |

| 2021.10.22 | Updated code lists, correcting English texts in merknad, added new element "fradrag" in merknadTilsvarendeMvaKode, nynorsk translations in mvaKodeSAFT. |

| 2021.11.02 | Updated code lists, added valid remarks for SAFT VAT codes 81, 1, 11, 12 and 13 in merknadTilsvarendeMvaKode, small update to kodetillegg for SAFT VAT code 12, 1 and 81 in mvaKodeSAFT. |

| 2021.11.09 | Updated code lists, removed remarks with "uttak" for code 32 merknadTilsvarendeMvaKode. |

| 2021.11.29 | Updated code lists, corrections to code 81 in merknadTilsvarendeMvaKode. |

| 2021.12.03 | Updated code list summary, added adjustment specification for code 81. |

| 2021.12.07 | Minor updates to description of spraakTekst in mvaKodeSAFT.xml |

| 1 2022.12.08 | Added specifications for compensation that can be used in the VAT-report after 2022. |

Version 1.0 of the XSD for the VAT return

Version 1.0 of this XSD is found here no.skatteetaten.fastsetting.avgift.mva.skattemeldingformerverdiavgift.v1.0

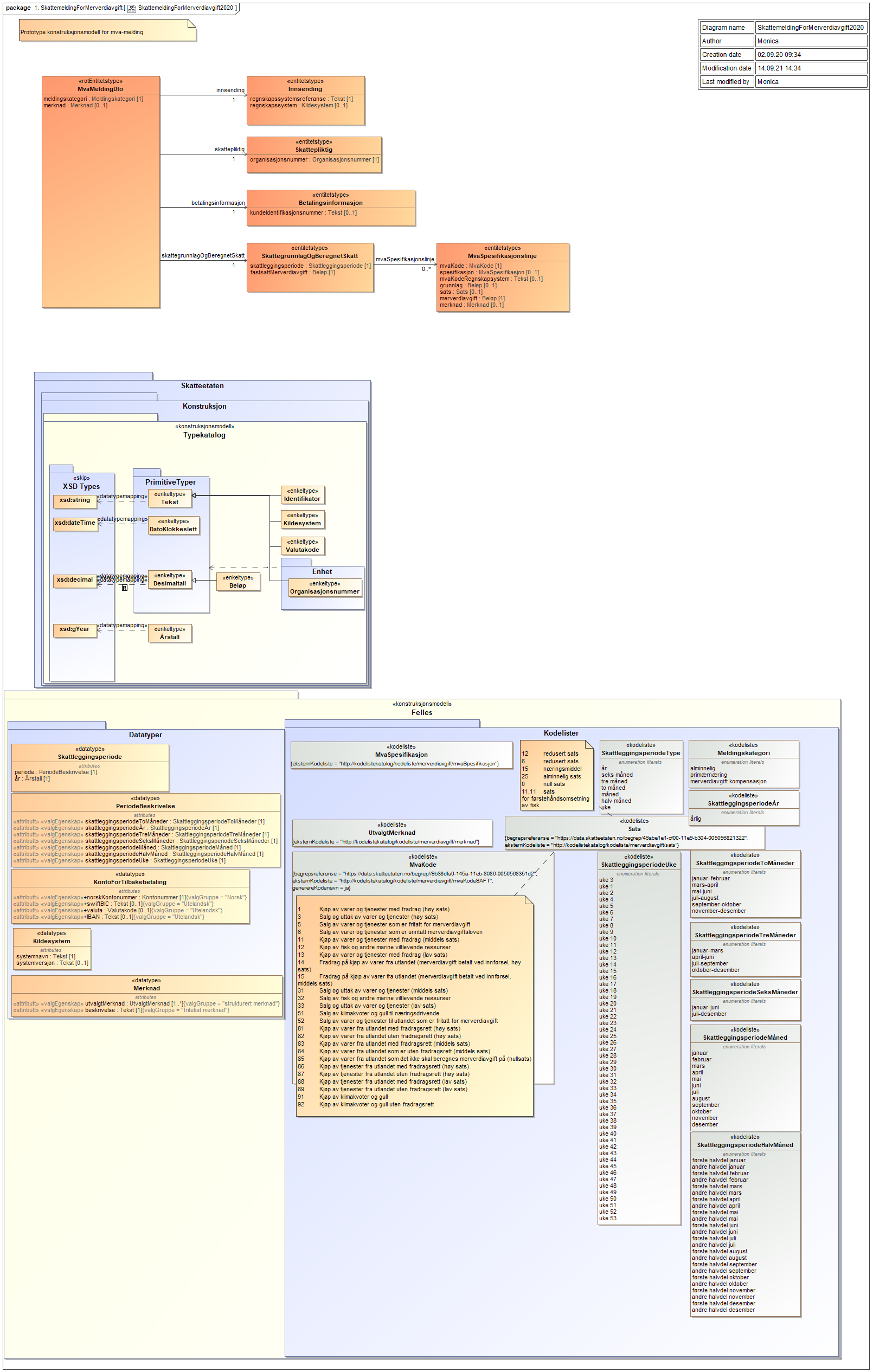

Graphical representation of the XSD and encoding for the VAT return:

The SAF-T standard also contains the codes 0 (No VAT treatment), 7 (No VAT treatment - no turnover according to the VAT legislation), 20 (No VAT treatment), 21 (Basis on import of goods, regular rate) and 22 (Basis on import of goods, reduced rate, middle). These should not be reported in the VAT return

Compensation in the general VAT-report

On 01.01.2023, the specification " Purchase with right to VAT compensation" was added to 5 codes in the VAT report, in addition to the existing specifications. The affected codes with the new specification are 81, 83, 86, 88 and 91. What these codes have in common is that the import of goods and services (plus the domestic purchase of climate quotas and gold) triggers outgoing import value added tax. This means that businesses using these codes are either entitled to compensation for input VAT or direct right of deduction for input VAT. Businesses that use these codes in their ordinary VAT declaration can claim compensation by submitting the tax return for VAT compensation in addition to the general VAT-report.

Examples of VAT-returns

Examples of VAT-return in Excel

Corresponding example files for VAT return in XML format

Description of the fields in the VAT return

MvaMelding (VAT-return)

| Field | Description |

|---|---|

| meldingskategori | The subtype of the VAT return Purpose: to ensure that the user can fulfill their VAT reporting obligations |

| merknad | Additional information about the content of the VAT return Purpose: to ensure that the taxpayer have the possibility to explain their application of law when necessary |

Skattepliktig (Taxable organization)

| Field | Description |

|---|---|

| organisasjonsnummer | Unique identifier for the taxable organisation Purpose: to take care of the rights and obligations of the taxpayer |

Innsending (Submission)

| Field | Description |

|---|---|

| regnskapssystemrefereanse | The taxpayers unique reference for the submission Purpose: To ensure that the taxpayer and the tax office refer to the same message. |

| system | Name and possible version of accounting system Purpose: To be able to follow up systematic errors with the system supplier instead of following up each individual taxpayer. |

Betalingsinformasjon (Payment information)

KID is only applicable if the business is to get VAT back from the Tax Authority.

| Field | Description |

|---|---|

| KID | The recipient's identification of a payment Purpose: To be able to pay to the bank accounts that require KID |

Skattegrunnlag og beregnet skatt (Tax basis and calculated tax)

| Field | Description |

|---|---|

| skattleggingsperiode | The taxation period for which the VAT return applies Period is stated in accordance with the code list for the Skattleggingsperiode. SkattleggingsperiodeUke follows the calendar's week numbering, for example week 1 in 2022 runs from 3 to 9 January. For SkattleggingsperiodeHalvmåndelig, the first half runs from the 1st to the 15th of the month and the second half runs from the 16th to the last of the month. Purpose: to ensure consistency between bookkeeping and VAT return period |

| fastsattMerverdiavgift | Sum to pay / sum to be refunded Purpose: to ensure that the correct amount is being paid |

MvaSpesifikasjonslinje (VAT-specification line)

| Field | Description |

|---|---|

| mvaKode | Classification of incoming and outgoing VAT in accordance with the Norwegian SAF-T standard Purpose: dissemination of which VAT assessments have been carried out |

| spesifikasjon | Detailing some VAT conditions that are not included in the Norwegian SAF-T standard Purpose: dissemination of which VAT assessments have been carried out |

| mvaKodeRegnskapssystem | Internal VAT code in the accounting system. There may be several internal VAT codes for a VAT code and possibly a specification. In that case, there will be several lines in the VAT message per VATCode and specification; one per combination of VAT code, specification and VAT CodeAccounting system. Purpose: Two considerations Users: recognizable in relation to what they see in the accounting system. The system suppliers will not have to change VAT codes in the systems |

| grunnlag | The amount of which VAT is calculated.

The field must not be filled in for input VAT. Purpose: Basis for control from the Tax Administration |

| sats | The VAT rate used in calculating outgoing VAT.

The field must not be filled in for incoming VAT. Purpose: To ensure that only valid rates are used for invoicing |

| merverdiavgift | Fixed VAT Purpose: to show calculated VAT per line |

| merknad | Information about the content of mvaKode Purpose: to ensure that the taxpayer can explain his own application of the law where necessary |

Description of the fields in the VAT return submission

MvaMeldingInnsending (VAT return submission)

| Felt | Description |

|---|---|

| meldingskategori |

The subtype of the VAT return Purpose: to ensure that the user can fulfill their VAT reporting obligations |

| innsendingstype |

A VAT return with meldingskategori alminnelig og primær will always be komplett Purpose: The field is kept so at a later date it can be opened for auditors to comment/write notes on those vat returns (e.g. VAT compensation) that should be approved by an auditor before submission. |

| instansstatus |

This field will be removed since we get the required information from the events on the instance. This will be done by making the field optional in a transition and removed at a appropriate time. |

| opprettetAv |

This field should contain the name of the logged in user. Purpose: The content of this field will be displayed in Altinn. |

| opprettingstidspunkt |

This field will be removed since we get the required information from the events on the instance. This will be done by making the field optional in a transition and removed at a appropriate time. |

Identifikator (Identifier, Either organisasjonsnummer or foedselsnummer)

| Felt | Description |

|---|---|

| organisasjonsnummer |

Unique identifier for the taxable organisation Purpose: to take care of the rights and obligations of the taxpayer |

| foedselsnummer |

Unique identifier for the taxable organisation Purpose: to take care of the rights and obligations of the taxpayer |

Skattleggingsperiode (taxation period)

| Felt | Description |

|---|---|

| periode |

The taxation period for which the VAT return applies Period is stated in accordance with the code list for the Skattleggingsperiode. SkattleggingsperiodeUke follows the calendar's week numbering, for example week 1 in 2022 runs from 3 to 9 January. For SkattleggingsperiodeHalvmåndelig, the first half runs from the 1st to the 15th of the month and the second half runs from the 16th to the last of the month. Purpose: to ensure consistency between book keeping and VAT return period. |

| aar |

The taxation year for which the VAT return applies Purpose: to ensure consistency between book keeping and VAT return period. |

Vedlegg (Attachment)

| Felt | Description |

|---|---|

| vedleggstype | Type of attachments which is uploaded to the instance on Altinn. Where you can either use mva-melding for the VAT return, or binaerVedlegg for general attachments. |

| kildegruppe |

Which group the submission comes from. Options: etat, sluttbrukersystem, sluttbruker |

| opprettetAv |

This field should contain the name of the logged in user. Purpose: The content of this field will be displayed in Altinn. |

| opprettingstidspunkt |

This field will be removed since we get the required information from the events on the instance. This will be done by making the field optional in a transition and removed at a appropriate time. |

Vedleggsfil (Attachment file)

| Felt | Description |

|---|---|

| filnavn |

Name of the file which is uploaded as attachment |

| filekstensjon |

The file extension for the file which is uploaded as attachment |

| filinnhold |

Description of the contents of the file which is uploaded as attachment |

Encoding (code List)

| Group and code | Description of code, deductions and specification |

|---|---|

| Sales of goods and services in Norway | |

| 3 | Sales and withdrawals of goods and services (standard rate) |

| Specification line for code 3 | Withdrawal |

| 31 | Sales and withdrawals of goods and services (middle rate) |

| Specification line for code 31 | Withdrawal |

| 33 | Sales and withdrawals of goods and services (low rate) |

| Specification line for code 33 | Withdrawal |

| 5 | Sales and withdrawals of goods and services exempt from value added tax (zero-rate) |

| Specification line for code 5 | Withdrawal |

| 6 | Sales and withdrawals of goods and services outside the scope of the Value Added Tax Act |

| Sales of goods and services to other countries (exports) | |

| 52 | Sales of goods and services exempt from value added tax to other countries (zero-rate) |

| Purchases of goods and services in Norway (deduction) | |

| 1 | Purchases of goods and services with deduction (standard rate) |

| Specification line for code 1 | Losses on outstanding claims and cancellations |

| Specification line for code 1 | Adjustment of input VAT on capital goods |

| Specification line for code 1 | Reversal of input VAT on passenger vehicles or Sale etc of real property before completion |

| 11 | Purchases of goods and services with deduction (middle rate) |

| Specification line for code 11 | Losses on outstanding claims and cancellations |

| 13 | Purchases of goods and services with deduction entitlement (low rate) |

| Specification line for code 13 | Losses on outstanding claims and cancellations |

| Purchases of goods from abroad (import) | |

| 81 | Purchases of goods from abroad with deduction (standard rate) |

| 81 | Deductions on purchases of goods from abroad (standard rate) |

| Specification line for code 81 | Reversal of input VAT on passenger vehicles or Sale etc of real property before completion |

| Specification line for code 81 | Adjustment of input VAT on capital goods |

| Specification line for code 81 | Purchases with compensation for VAT |

| 14 | Purchases of goods from abroad, value added tax paid upon import (standard rate) |

| 82 | Purchases of goods from abroad without deduction (standard rate) |

| 83 | Purchases of goods from abroad with deduction (middle rate) |

| 83 | Deductions on purchases of goods from abroad (middle rate) |

| Specification line for code 83 | Purchases with compensation for VAT |

| 15 | Purchases of goods from abroad, value added tax paid upon import (middle rate) |

| 84 | Purchases of goods from abroad without deduction (middle rate) |

| 85 | Purchases of goods from abroad with a zero-rate |

| Purchases of services from abroad (import) | |

| 86 | Purchases of services from abroad with deduction (standard rate) |

| 86 | Deductions on purchases of services from abroad (standard rate) |

| Specification line for code 86 | Purchases with compensation for VAT |

| 87 | Purchases of services from abroad without deduction (standard rate) |

| 88 | Purchases of services from abroad with deduction (low rate) |

| 88 | Deductions on purchases of services from abroad (low rate) |

| Specification line for code 88 | Purchases with compensation for VAT |

| 89 | Purchases of services from abroad without deduction entitlement (low rate) |

| Fish etc. | |

| 32 | Sales of fish and other marine wildlife resources (11,11%) |

| 12 | Purchase of fish and other marine wildlife resources (11,11%) |

| Specification line for code 12 | Losses on outstanding claims and cancellations |

| Emission allowances and gold | |

| 51 | Sales of emission allowances and gold to businesses/self-employed persons |

| 91 | Purchases of emission allowances and gold with deduction (standard rate) |

| 91 | Deductions on purchases of emission allowances and gold (standard rate) |

| Specification line for code 81 | Purchases with compensation for VAT |

| 92 | Purchases of emission allowances and gold without deduction entitlement (standard rate) |

Overview of encoding/ code list:

- Encoding for VAT code: mvaKodeSAFT

- Encoding for VAT specification: mvaSpesifikasjon

- Encoding for VAT rate: sats

- Encoding for remarks: merknader

- Encoding for remarks and corresponding VAT code: merknadTilsvarendeMvaKode.xml

XSD for uploading metadata

The submission of the VAT return requires an XML file containg metadata. This file must be according to the XSD for submission.

no.skatteetaten.fastsetting.avgift.mva.mvameldinginnsending.v1.0.xsd

XSD for validation response

XSD for validation documents the structure of the response from the validation service. The feedback will also be according to this XSD. no.skatteetaten.fastsetting.avgift.mva.valideringsresultat.v1.xsd

XSD for payment information

no.skatteetaten.fastsetting.avgift.mva.skattemeldingformerverdiavgift.betalingsinformasjon.v1.0.xsd